This is a contributed article from Samantha Novick, a senior editor at Funding Circle.

Successfully managing your finances is essential for small business survival—global pandemic or not. Around 82% of failed businesses claim cash flow was to blame for their demise, and that percentage is only likely to rise amidst something like the COVID-19 crisis.

Your business doesn't have to become a statistic. With a little organization, cost-cutting, and additional funding, you can manage your finances during this COVID craziness and come out of it all stronger than ever.

First, you'll need to get your books in order. Then, you can start finding ways to take control of your cash flow. And finally, you can explore COVID-19 small business loans, grants, and other relief options that can help fill in the gaps. Let's walk through it step-by-step.

Get Your Books in Order

Whether your business is temporarily closed, full-on remote, or something in between, there's no better time to get a handle on your money. Your local business's success depends on you making more than you spend, but you'll never have an accurate, up-to-date look at your cash flow if your finances are jumbled. It's time to get organized.

Perform an Audit

If your goals are your business's compass, then consider an internal audit as your map. To get where you want to go, you need to have a good idea of where you currently stand. To do this, you'll want to review your:

- Assets - How much cash do you have? What about liquid assets like inventory and equipment? Do you own your business's real estate?

- Liabilities - How much do you currently owe? Do you have any outstanding invoices to pay or loan payments to make?

- Savings - Have you set aside any cash for a rainy day fund? Do you have a business line of credit or credit card you can tap into?

Once you're finished with the audit, you'll have a better idea of how your business is doing. If your liabilities exceed your assets, then you know something needs to change—fast. But don't panic! The rest of this guide can help get your business back on track and headed in the right direction.

If your financials seem off, then it's time to do some bookkeeping spring cleaning. It's better to do this now rather than wait until July when you're scrambling to file your taxes.

Clean Up the Mess

Nobody likes deep cleaning, but a thorough tidying up now can make maintenance a breeze later. Here are a few ways to neaten up:

- Move to the cloud - If you haven't yet, gather up all your paperwork (receipts, bank statements, bills, invoices) and upload it to a bookkeeping management tool. You don’t have to spend a penny — there are plenty of free tools (including special COVID-19 offers) on the web. A digital cloud-based bookkeeping solution will clean up your papers, automate your processes, generate reports, and much more to make managing your finances quick and easy. Plus, you can access important documents, whether you’re at the office or sitting on your couch.

- Organize your transactions - Make sure you import and categorize all your income and expenses to have an up-to-date look at your cash flow. Without accurate records, you won't be able to make reliable forecasts—and any business decision without projections (or other data) is just guesswork.

- Double-check your inventory - Verify that the stock you have on hand is the same amount you have in the books. If there's a discrepancy, find and fix the problem now before it potentially gets worse.

- File your taxes - While the IRS has extended federal tax deadlines until July 15, that doesn't mean you shouldn't get it done sooner rather than later. If the government owes you a refund, then filing can help expedite the process. Plus, you can always file your return now and then pay the taxes you owe on July 15.

Prepare Financial Statements

Financial statements transform your many transactions into digestible reports that tell you how your business is doing. If you haven't created financial statements in the past, now is an excellent time to start.

When you're finished cleaning up your records and organizing your transactions, retroactively create financial statements for as far back as you can. These reports will help you compare month-to-month, quarter-to-quarter, and year-to-year.

Historical records like this may inform you that May is always an extra slow month, so you’ll need to budget more. Or it may tell you that the peak of your seasonal sales usually comes at the end of August so you will need to hire seasonal staff. Of course, COVID-19 makes things a little bit more tricky to predict the future — but that doesn’t mean you can just close your eyes and hope for the best.

The three critical financial statements you should create and analyze are:

- Profit and Loss Statement (P&L) - Your P&L report (also known as the income statement) shows sales, expenses, and resulting profit (or loss) for a specific period. If your reports show a profit, then congratulations—now look for ways to optimize, improve, and scale. If your reports show a loss, take a step back and look for ways you can cut costs (more on that later) or boost sales.

- Balance Sheet - Your balance sheet illustrates your entire financial situation at a specific moment in time, like a freeze-frame. It contains your assets, liabilities, and equity—in a nutshell, what you own, owe, and what’s leftover.

- Cash Flow Statement - This report shows how cash flows in and out of your business over a specific period. The goal is for your business to have more money coming in that going out—that's a good sign of a healthy, well-functioning business.

Bookkeeping software will produce these reports, but you can also find a bunch of downloadable Excel and Google Doc templates on the web.

Create Up-to-Date Cash Flow Forecasts

With your financial statements in hand, you're ready to start forecasting your cash flow. Historical and current data will produce more realistic estimates so you can budget and make smart financial decisions moving forward. Pay special attention to the financial impact the pandemic has had on your business (this calculator might help), and make sure to account for that in your forecasts.

Cash flow forecasts are educated projections regarding the cash you will earn and pay. These forecasts help you identify gaps and opportunities in advance so that you still have time to respond. The SBA recommends you should have a 3-month forecast (but it certainly doesn’t hurt to forecast for a few different ranges of time).

For example, if you predict an upcoming cash shortage, you may need to secure a business line of credit or another form of short-term financing. And if you foresee a jump in revenue, you can plan for how you're going to use that extra cash (investments, savings, bills).

Before this pandemic, having a Plan A was adequate. And having a Plan B and Plan C was pretty great. Now, COVID-19's taught us all that you need Plans A, B, and C — then you need to be ready to scrap all of them and start over again.

What are Plans A, B, and C? Well, it’s crucial that you “stress-test” multiple scenarios:

1. Most likely - What if things go as predicted?

2. Best-case - What if things go better than expected?

3. Worst-case - What if things go worse than expected?

Given the uncertainty that COVID-19 has cast over the future, it’s essential to know your cash situation in terms of several outcomes.

As of now, it’s being left up to states to decide when to start things back up. Several states are easing restrictions over the coming weeks, while others have imposed shelter-at-home orders through the beginning of June. Make sure you’re staying up-to-date with local policy (as well as larger industry and economic trends), so you can make more informed decisions for your business. No matter what happens, you want to have a gameplan.

Conserve Your Cash

To boost your bottom line, you either have to make more cash or cut more costs—or do both. During a pandemic, it's hard to boost your sales unless your industry and products are primed for the occasion. And local businesses are certainly making it work. Coffee shops and restaurants are making the move to mobile and transitioning to takeout.

However, there are also plenty of opportunities to reduce expenses and conserve your cash.

Eliminate discretionary spending

Only spend money on absolute essentials. Look at your cash flow statement and determine what's a need-to-have and what's a nice-to-have. If the expense isn't directly tied to sales, then there's a good chance it can be temporarily cut.

For example, if you're hurting for cash, now's probably not the time to produce costly marketing assets (like high-end videos or super-polished design work). Perhaps you nix the marketing experiments for the time being and focus on tried-and-true tactics that consistently produce high ROI (like email marketing).

And if your team is full-remote, consider pausing your office's internet package, regulating the in-office temperature, and canceling employee subscriptions they can't currently use (like transportation benefits or office snack stocking).

Renegotiate where you can

No country, state, or city has escaped the COVID-19 pandemic unscathed—it's impacted the entire world. As a result, your partners and lenders may be more lenient with adjusting your payment terms to help you through the crisis.

- Review your lease to see your legal obligations as a tenant, and check for any clauses (like a “force majeure”) that would excuse you from having to pay rent given the circumstances. Be proactive, not reactive. Call your landlord as soon as you anticipate an issue with paying rent to see if you can restructure your lease.

- Work with your providers (SaaS, Internet, payroll) to see if you can get a better deal or a temporary rate reduction. Tons of companies have already announced COVID-19 relief, so check to see what offers are available (more on this later).

- Talk to your lenders to see if you can get temporary payment deferrals or make an adjustment to your payment schedule. You may be able to refinance and score a better interest rate or more convenient terms.

- Contact your vendors, suppliers, and clients, and ask for assistance. You can bolster cash by restructuring payment terms — delaying your outgoing payments (accounts payable), and speeding up your incoming payments (accounts receivable). Ask your vendors and suppliers if you can postpone a payment, or try to figure out some sort of alternative arrangement. Call your customers about paying early, and consider offering a discount (such as a certain percentage off) if they pay within a certain timeframe. Consider adjusting your invoice terms moving forward, but do so with care. It’s not worth risking a valuable customer relationship.

Everyone's sensitive to the impact COVID-19 is causing, and you'll be surprised how generous some of your contacts can be. Your vendors, suppliers, and partners need businesses like yours to survive, and they’ll do their part to accommodate your needs. Especially if you have a longstanding relationship and your payment history is credible.

And remember that your clients and debtors are in a similar situation as you (maybe worse, maybe better) — so listen to their needs as well. Odds are, you can come up with some sort of compromise that works for both parties.

Get Funding — Before You Need It

Secure capital before you need it. Right now, there are several financial aid programs available that you should know about.

Federal Aid

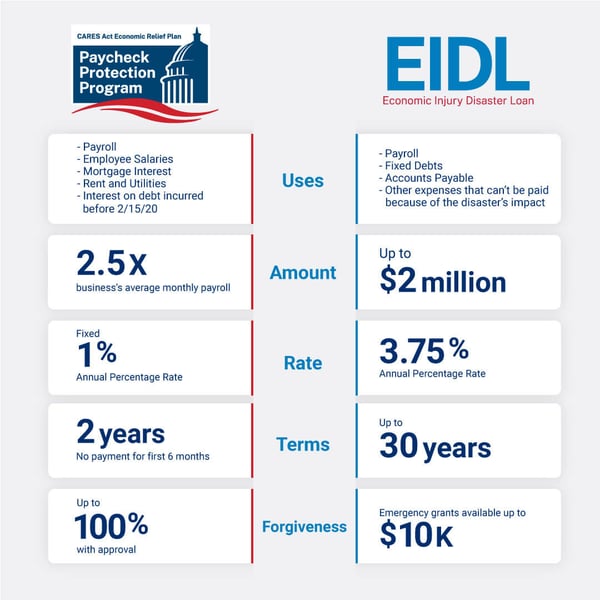

Under the CARES Act, $377 billion was earmarked for small businesses. A majority of the funds were allocated to the newly established Paycheck Protection Program and the recently updated Economic Injury Disaster Loan Program.

Initial funds for both programs were exhausted. The Paycheck Protection Program ran out of $349 billion within 14 days. But there’s good news: a $484 billion package has been passed by the Senate and House, and the bill could be approved as early as Friday by the President with $320 billion designated for the Paycheck Protection Program and another $60 billion allocated to the Economic Injury Disaster Loan Program. There are a ton of applications already in the pipeline, so you don’t want to wait. Get your documentation prepared and application submitted as soon as possible to save your spot.

And here’s a brief low-down on each program.

- Paycheck Protection Program (PPP) - Established in response to COVID-19, the PPP offers small businesses 100% forgivable loans of up to $10 million. Your maximum loan amount will be equivalent to 2.5 times your average monthly payroll expenses. You can use this handy Paycheck Protection Program Calculator to figure out the amount you may be eligible to borrow. Whatever portion of the loan proceeds you use for qualifying payroll and operating expenses (over the eight weeks from the loan was issued) will be forgiven as long as you maintain your employee headcount. The portion of your loan that is not forgiven will carry a flat 1% interest rate and terms of two years. You won’t have to make payments for the first six months (but interest does accrue).

- Economic Injury Disaster Loan (EIDL) - This program offers small businesses low-interest loans of up to $2 million to help cover working capital expenses. An EIDL loan comes with terms of up to 30 years and a fixed interest rate capped at 3.75%. Since time is of the essence, small businesses can also apply for an EIDL Emergency Advance of up to $10,000 ($1,000 per employee). You do not have to repay this advance.

Regional and Local Assistance

It’s not just the federal government that has taken swift action to provide financial relief to cash-constrained small businesses. Many states, counties, and cities are issuing their own relief initiatives to keep local businesses afloat. You can search this list, which is organized by state, to find COVID-19 financial resources available in your area. We’ve highlighted a few programs below:

- Denver - Small business owners within the city and county of Denver can apply for up to $7,500 in cash grants.

- Utah - Through the Utah Leads Together Small Business Bridge Loan Program, small businesses can apply for loans from $5,000 to $20,000 with 0% interest for up to 60 months.

- St. Louis - For-profit businesses in the city of St. Louis or St. Louis County are eligible to apply for zero-interest loans of up to $5,000 for working capital.

- Iowa - Small businesses with one to seven employees, who have not received Federal and State small business relief dollars, are eligible to apply for grants ranging from $500 to $3500.

- Chicago - Small business owners can apply for low-interest loans of up to $50,000.

The demand is extremely high. These microloans, grants, low-interest loans, and other relief options are going fast. Keep a close eye on announcements from your local leaders (mayors and governors) so you can stay on top of these opportunities as soon as they’re available.

Short-Term Financing

If you’re facing an immediate cash crunch and need funds fast, several options can help you use to bridge the gap:

- Business Line of Credit - Use a revolving business line of credit to pay for practically any expense — they’re one of the most flexible borrowing options out there. Whether you need to make payroll, pay an invoice, or take care of rent, a line of credit has you covered. The approval process can take as long as seven days. But once you get approved, use, repay, and reuse your credit up to a certain limit as many times as you like (assuming you’ve paid back what you borrowed). You also are under no obligation to use your line of credit (ever). And you only pay interest on what you borrow. So technically, you can keep a business line of credit in your back pocket without spending a dime. Of course, you should always check the fine print before you sign on the dotted line.

- Business Credit Card - You can use a business credit card on your business expenses, just like you'd use your credit card for personal expenses. Swipe here and swipe there to take care of small purchases that pop up. Use your card to restock on office supplies, pay the month's rent, or purchase inventory. Pay off your balance in full each month to avoid high interest charges. You may consider making minimum payments temporarily to preserve cash, but be extra careful if you go this route. Credit card debt is not cheap. If you decide to get a business credit card, do your research to see what features would be the most beneficial. For example, maybe a card with a 0% APR for the first 12 months makes sense if you need a bit of wiggle room with payments. Or if you have recurring large bulk orders that you pay back relatively quickly each month, you may opt for a card that gives you cash back on purchases. It usually takes a week to get approved and start using your card.

- Merchant Cash Advance (MCA) - Merchant cash advances are arguably the fastest borrowing option out there. You can often get funds within just a few hours. But they’re also arguably the most expensive; the average APR runs from 20% to 250%. With an MCA, you receive a lump sum upfront in exchange for a percentage of your future daily credit card sales (plus fees). The repayment term is typically 8 or 9 months. Sometimes it can be as long as 30 months. How much you pay is proportionate to how much you bring in. So, when sales are up, you pay more, and when sales are down, you pay less.

- Invoice Factoring - Invoicing factoring might be a good option if you’re dealing with cash flow tied up in pending invoices. You sell outstanding accounts receivable to a factoring company in exchange for a cash advance. The factoring company provides you with an advance equal to 80 to 85% of the value of your invoice. Once the factoring company gets paid by your customer (they take over the collection process), you get the remaining balance, minus any fees. How much this borrowing option ends up costing you depends partially on your customer’s timeline. Generally, the longer it takes your customer to pay, the more you’ll end up paying in fees. Also make sure you know if the factor is “recourse” or “nonrecourse” — this will determine who is responsible for an unpaid invoice, you, or the factoring company.

Remember - Short-term financing options are not supposed to be a long-term solution. They’re great in a pinch because they provide funds so fast. But speed comes at a price. And sometimes, these higher-interest loans can end up doing more harm than good.

Take Advantage of COVID-19 Relief

In response to COVID-19, you can find tons of different relief resources beyond what we’ve already mentioned above. These deferments and other forms of reprieve can give your cash flow a much-needed boost and ease financial pressure — at least a bit. Governments, lenders, nonprofits, tech companies, and more are uniting to help:

- SBA Debt Relief - If you have a current 7(a), 504, or microloan, the Small Business Administration will automatically pay the principal, interest, and fees for a period of six months. The same financial reprieve also applies to new 7(a), 504, and microloans issued before September 27, 2020.

- Tax provisions - In addition to the deadline to file small business taxes being extended by three months, but there are several other tax benefits that you should be aware of:

- Employee Retention Tax Credit - Employers are eligible for a 50% refundable payroll tax credit of up to $10,000 paid in wages per employee. You can't use both a PPP loan and a payroll tax credit, so choose wisely.

- Payroll Tax Deferral - Employers can take a break on employer-side Social Security payroll taxes with the first half of payments not due until December 31, 2020, and the remaining half not due until December 31, 2022. If you have a PPP loan, there’s one other thing you should know. Once you receive a decision that any portion of your PPP loan is forgiven, you will no longer be eligible to defer payments.

- State taxes - In addition to federal tax relief, many states have also implemented their own tax relief measures from waiving late payment penalties to extending filing and payment deadlines.

- Some additional tax-related notes on the PPP:

- Typically loan forgiveness is considered “taxable income” under federal law (and states tend to follow suit by incorporating into their own tax codes). But, the CARES Act makes a specific exception for the PPP under Section 1106 — the amount forgiven “shall be excluded from gross income” for federal tax purposes. As for whether this applies to states, it’s still a bit unclear. If your business is located in a state that has conformed to the most recent version of the Internal Revenue Code (IRC), you should be all set. That is, unless your state has adopted a specific law in response to the CARES Act provision. Otherwise, you will be taxed on the state-level — it all depends on if and when the IRC is updated.

- When you pay an employee, you get a deduction on your federal tax return. This also applies to the PPP — if you use any of your loan proceeds to pay employees (and your loan forgiveness depends on you doing so anyway), then it appears you still get a deduction for those payments.

- Eviction bans - Some states and local governments have established eviction moratoriums — meaning, landlords are not allowed (at least temporarily) to evict their residential and commercial tenants who are unable to pay rent due to COVID-19.

- Utilities - In many cities, utility providers are preemptively doing their part to provide reprieve through payment arrangements and rate reductions. Additionally, some cities are working with utilities to outline more official measures.

- Technology - Everyone from huge tech companies to more niche SaaS providers are doing their part to help small businesses. Many are offering their software and services discounted (and more often than not, free) for extended periods.

- Financial Institutions - Financial institutions are offering up support for their clients too. Check your bank’s website to see if they’ve made any announcements about financial assistance. You can also find a list of individual banks’ and credit unions’ relief measures here.

- Crowdfunding - Many businesses have started fundraising campaigns to support themselves and their staff. Your local customers are eager to help; you just have to tell them how. Set up a GoFundMe and get the word out — if you raise at least $500, you could qualify for a matching $500 grant.

- Grants - Private and nonprofit organizations alike have been emerging with grant opportunities for small businesses. Some are general, while others are industry-, location- or identity-based. Some are offering cash while others are offering ad credits — and a few are offering both. Certain cities, counties, and states are also offering grants to their small business constituents. So keep tabs on your administrator’s website for up-to-date information about what’s available.

Find a Professional

You should probably consult a professional (tax) accountant or bookkeeper before you make any major decisions. They can provide smart advice for your unique circumstances while helping you navigate the COVID-19 crisis strategically.

Don’t know where to find one? Nextdoor can help. You can use the neighborhood hub to search directly for trustworthy accountants and bookkeepers in your area.

A Final Thought on Managing Finances

When it comes to the nitty-gritty of managing your finances, it’s important to remember — this is something you cannot just set and forget. As your financial situation morphs, which it inevitably will, you want to update your statements and forecasts so you can adjust your plans and budget accordingly.

For more resources to help your business during coronavirus, visit our Small Business Guide for Coronavirus Relief.

.jpg)

-1%20(1).jpg?width=200&name=iStock-1140598547%20(1)-1%20(1).jpg)

.jpg?width=200&name=NextdoorOakland-134-min%20(1).jpg)

.jpg?width=200&name=iStock-1160229044-min%20(1).jpg)